-

CALL US 0203 883 4777

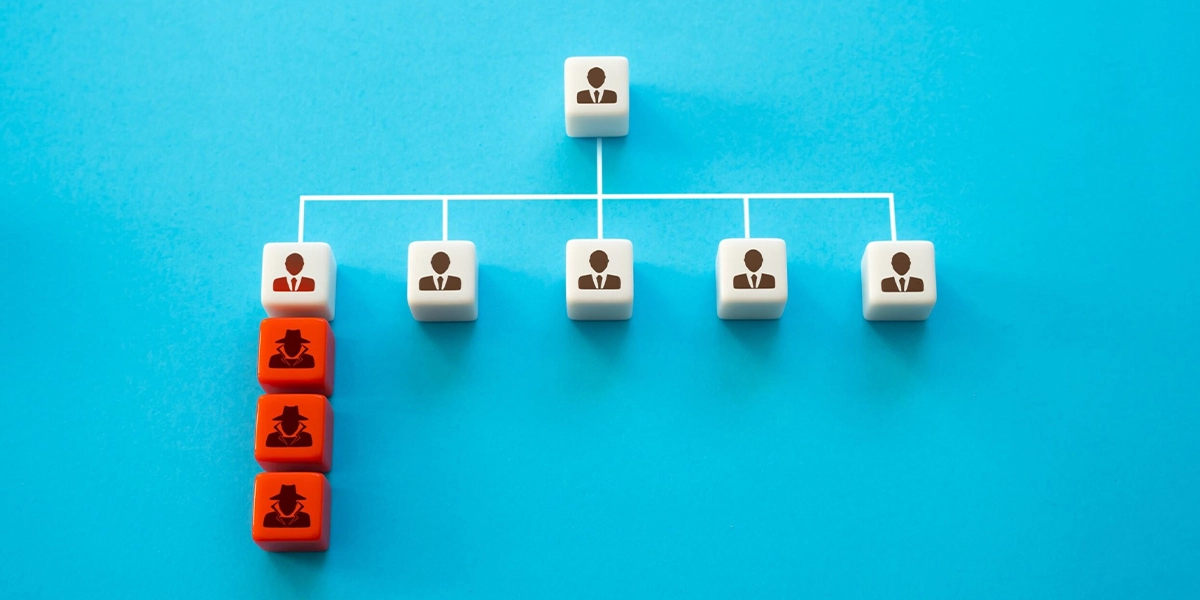

Understanding Liabilities Associated With Business Structures

The liabilities associated with business structures play a critical role in determining risk exposure for business owners. Therefore, it is essential to understand the variations in liability across different structures to choose the right one for your business. By carefully considering how each structure impacts liability, you can make informed decisions that significantly reduce personal financial risk and ensure your assets remain protected.

Liabilities of Sole Traders

Sole traders face the highest liabilities among all business structures. They do not have a legal distinction between personal and business assets, which puts personal finances—including homes and savings—at risk if the business incurs debt or faces legal claims. While many choose this structure for its simplicity, it carries significant risk exposure, especially in scenarios involving debt or litigation. Sole traders must recognise that their personal financial security is entirely tied to the business, making it essential to assess potential risks thoroughly.

Partnerships Liabilities

In a general partnership, the partners share the partnership’s liabilities. This means each partner is personally responsible not only for their own actions but also for the actions and debts of the other partners. The shared unlimited liability can significantly increase risk exposure, especially if one partner makes a poor business decision. With minimal liability protection, personal assets such as property and savings may be used to settle business debts. Therefore, partnerships must evaluate the risks involved carefully and establish strong agreements to manage potential liabilities effectively.

Limited Liability Partnerships (LLPs)

LLPs’ liabilities differ from traditional partnerships, as this structure offers limited liability protection for each partner. This protection shields personal assets from business debts, and each partner’s liability remains limited to their investment in the business. This makes LLPs a more attractive option for firms seeking flexibility while reducing personal financial risk. LLPs provide a balance between the flexibility of a partnership and the protection of limited liability, making them a favourable choice for professionals who want to mitigate risks without sacrificing control over operations.

Liability of Limited Companies

Limited companies offer the highest level of protection regarding liabilities associated with business structures. As separate legal entities, limited companies restrict liability to the business itself, protecting shareholders and directors from personal responsibility. This protection keeps personal assets safe from business debts and legal claims, significantly reducing risk exposure. This structure benefits businesses with higher liability concerns, allowing owners to invest in growth without fearing personal financial ruin due to business failure or unforeseen legal issues.

Conclusion

Choosing the right business structure is critical to managing the liabilities associated with business structures and ensuring your financial security. At Apex Accountants, our business structure consulting services provide expert advice tailored to your specific needs. We also offer business restructuring services UK to ensure your business is well-protected against potential risks.

Get expert advice from Apex Accountants today to safeguard your personal assets and mitigate risks with the right business structure decisions!

Recent Posts

Strategic Inheritance Tax Planning for Family Investment Companies in the UK

Rising property and investment values mean more UK families face Inheritance Tax (IHT) on their estates. To manage this effectively,...

What You Need to Know About HMRC Scrutiny of Family Investment Companies

Family Investment Companies (FICs) have become a popular way for UK families to manage wealth, protect assets, and plan succession....

VAT Registration for SPVs for Properties: What You Need to Know

In the UK property market, Special Purpose Vehicles (SPVs) are commonly used to own, manage, or sell property projects while...

Comprehensive Advice on VAT for Market Research Companies in the UK

Foreign research agencies entering the UK market face complex VAT obligations that directly impact pricing and profitability. When it comes...

Why Accounting for Market Research Companies Is Essential for Growth

Market research firms are the backbone of evidence-based decision-making across the UK. From consumer behaviour studies and digital analytics to...

Real-Time Bookkeeping for Market Research Companies in the UK

Market research firms manage multiple projects at the same time. Each project has its own budget, timeline, and resources. Without...

Annual Accounts for Appliances Manufacturing Companies under New 2026 FRS Updates

The UK appliance manufacturing sector is driven by high-volume production, detailed supply chains, and complex customer contracts. In this fast-moving...

Why Cross-border Tax Planning for Electronics Businesses Is Essential in 2026

The UK electronics retail sector depends heavily on global sourcing. Components, finished devices, and accessories often come from multiple regions,...

Understanding HMRC Investigations for the Consumer Electronics Sector

The UK consumer electronics sector is fast-paced and high-value, with businesses handling frequent imports, online transactions, and complex supply chains....

VAT Challenges for Smart Device Retailers and Appliance Distributors in 2026

The smart technology and appliance market continues to expand rapidly in the UK. With increasing consumer demand, bundled services, and...